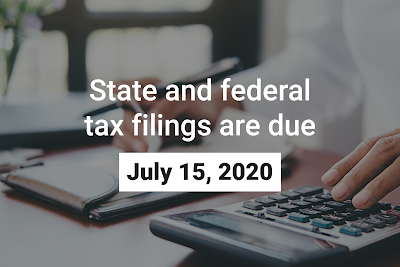

Nearly 25% of people over 65 years of age still need to file their 2019 income taxes, which are due on Wednesday, July 15.

While most Volunteer Income Tax Assistance (VITA) and AARP Tax-Aide programs, which provided free basic income tax return assistance, have suspended service due to the COVID-19 pandemic, the Illinois Department on Aging wants seniors to know that the following options are available at no charge to assist them with their 2019 tax returns:

- AARP Foundation Tax-Aide Online, or call (888) 227-7669

- LadderUP primarily for low-to-moderate income families

- Volunteer Income Tax Assistance and the Tax Counseling for the Elderly, or call (800) 906-9887

Open tax sites (please call to set up an appointment for site nearest you):

Christian County

Christian County Senior Center, Taylorville (217) 824-4263

Cumberland County Life Center of Cumberland County, Toledo (217) 849-3965

Jefferson County Wesley United Methodist Church, Mt. Vernon (618) 242-2879

Johnson County Southern Pride Senior Center, Vienna (618) 658-9669

Vienna Extension Center, Vienna (618) 973-0978

McLean County Activity and Recreation Center, Normal (309) 888-9099

Macon County Macon County Senior Center, Decatur (217) 429-1239

Marion County Calumet Christian Church, Centralia (618) 533-8890

First Christian Church, Salem (618) 740-1373

Massac County Happy Hearts Senior Center, Metropolis (618) 524-9755

Moultrie County Moultrie County CEFs Outreach, Sullivan (217) 728-7721

Pulaski County Shawnee Development Council, Karnak (618) 634-2201

Tazewell County Miller Senior Citizens Center, Pekin (309) 346-5210

Pekin Public Library, Pekin (309) 347-7111

Williamson County Williamson County Aging Programs, Herrin (618) 988-1585

Illinois taxpayers can file their state returns for free at MyTax.Illinois.gov. If you have income tax questions, email REV.TA-IIT@illinois.gov or call (800) 732-8866. Qualified taxpayers may also be eligible to participate in the IRS’ Free File program for federal returns. Email This BlogThis! Share to Twitter Share to Facebook Share to Pinterest